How to Prioritize Home Renovations and Repairs

While homeownership is a major milestone with many advantages, it comes with its share of challenges, especially when it comes to making repairs and upgrades. It can be difficult — and overwhelming — to decide which project to tackle first. We’ve outlined some tips for getting started and making progress toward your renovation goals.

Define Categories

First, consider each of the renovations on your wish list, and put them into these “buckets”: urgent, quality of life, added home value, and nice to have. Urgent renovations are those that directly affect the health and safety of the home’s residents. These can include mold, termite damage, structural or foundational issues, leaks, and electrical problems. Even if the need isn’t immediate, it’s important to determine if the problem has the potential to become more costly if not addressed in a timely manner.

No matter what, you should also make sure to set aside an emergency fund designated for urgent repairs that may pop up so you can keep your renovation plans on track.

There are also renovations that may not be time sensitive, but will improve your quality of life. These can be widely subjective based on your situation, age, and stage of homeownership, and can include adding bathrooms (especially on the main floor of the home), an in-law suite, home office, gym, or playroom, and aging-in-place additions like handrails, an accessible shower, or chair lifts

If your primary goal is to add value to your home, you’re likely to prioritize updates like kitchen or bath renovations and additions that add square footage and can “sell” the home. Don’t forget about exterior improvements, either: replacing your garage door, for example, can earn you more than a 93% return on investment. This bucket of renovations could actually outweigh quality of life renovations if you plan to sell in the next few years.

Finally, there are nice-to-have renovations and additions like a pool and pool house, custom closet, and high-end bathroom finishes that will enhance your home and living experience, but don’t need to be done if time or budget doesn’t allow.

4 Steps for Prioritizing Renovation Projects

- Make a list of your goals. Lay everything out, big and small, that you hope to accomplish with your renovations. Don’t overthink it — you’ll organize all of the goals in the next steps.

- Assign each goal to one of the above labels. Based on the above descriptions, categorize each of your items into urgent, quality of life, and nice to have.

- Reorganize the tasks.To make it easier to work through your list, rearrange the items so the urgent ones are at the top, followed by quality of life and nice-to-have renovations.

- Add estimated costs to each project. Create a budget by researching the rough costs for each repair or upgrade. Using a renovation calculator like the one here in our Home Equity Dashboard can help you more accurately predict the cost of your renovations. When it comes to urgent fixes, seek opportunities for having some of them completed at the same time. For example, if mold damage is forcing you to gut your bathroom, you may find that prioritizing any accessibility upgrades or high-end additions you had planned for later down the road will be more cost-efficient to complete now.

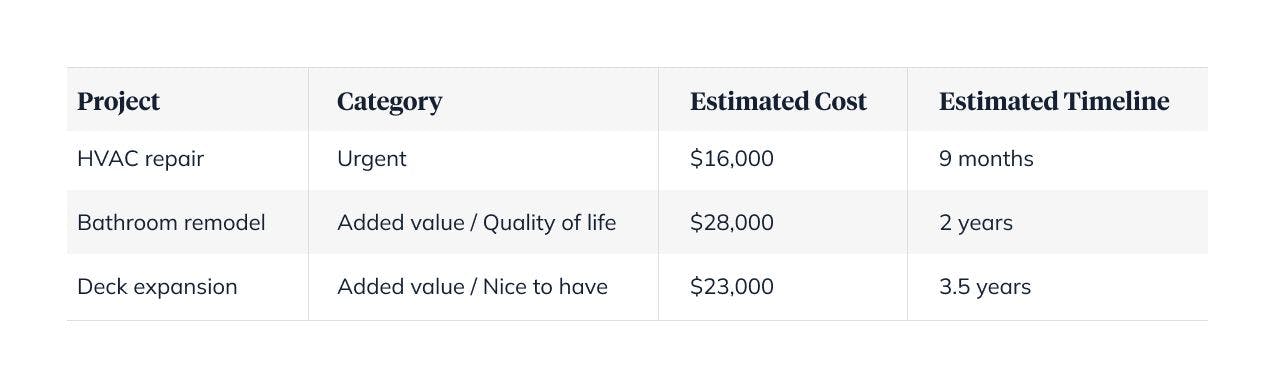

Once you’ve calculated each of your renovation costs, you can better estimate your timeline for achieving each of them as well. When your finished, your list should look something like this:

Decide How You’ll Finance Your Renovations

You may find that your lowest-priority renovations will take some time to get to. But you might be able to speed things up by leveraging a home financing solution. Here are some of the most popular choices to fund renovations:

Home Renovation Loans - There are personal loans you can use for home repairs and upgrades and they’re widely available from traditional lenders and banks. But the interest rates can be high, and qualification criteria may be stringent depending on the financial institution.

Home Equity Loans - One advantage of a home equity loan is that you receive a lump sum of cash, which can be helpful for renovation projects. In addition, the interest rate is fixed, so you’ll have a predictable monthly payment each month. However, since the loan comes on top of your existing mortgage, you’ll need to be prepared to deal with an additional payment.

Home Equity Line of Credit (HELOC) - A home equity line of credit not only provides flexibility in terms of how much money you can access and how often, but has its drawbacks. The interest rates are variable, so they’ll fluctuate from month to month.

Cash-out Refinance - With a cash-out refinance, you take out a new mortgage for which the balance is less than your original mortgage. You can often lock in a lower interest rate this way, but you’ll have to deal with the same fees you paid the first time around since it is a separate mortgage.

Home Equity Investment - Home equity investments provide homeowners with cash in exchange for a share of their home’s future value. While it depends on the investor, Hometap Investments don’t come with any monthly payments for the life of the investment (10 years). You receive the funds in a lump sum, and can use them for whatever you’d like.