What You Need to Know About Bridge Loans

You’re probably pretty familiar with a traditional mortgage loan, but you might not be as acquainted with the temporary financing fix known as a bridge loan (sometimes called a bridging loan). Learn about the advantages and disadvantages of this option, as well as alternatives to bridge loans that still enable you to access funding in a short time frame, below.

What Is a Bridge Loan?

A bridge loan is a short-term loan, typically with an effective period of less than six months, that can be used to “bridge the gap” and provide you with cash quickly while you secure a permanent financing solution.

Why Might I Need a Bridge Loan?

While bridge loans are common in business, you might need one as a homeowner if you’re looking to purchase another home but haven’t sold your current one yet, or plan to flip a property and need fast financing to cover the costs.

A bridge loan can also allow you to drop home-buying contingencies, which can be incredibly beneficial if you’re searching in a competitive market and need to move quickly to secure the new house.

Pros and Cons of Bridge Loans

Bridge loans can be relatively quick in terms of application, approval, and funding, but they come at a price — literally — in the form of high interest rates and origination fees, often requiring at least 20% equity as well.

In addition, being temporarily responsible for two mortgages on top of the bridge loan can be challenging and stressful, especially if you’re trying to sell your home and it isn’t garnering much attention from buyers. However, many homeowners are willing to pay extra costs and deal with the hassle in exchange for the convenience and speed that bridge lending solutions provide.

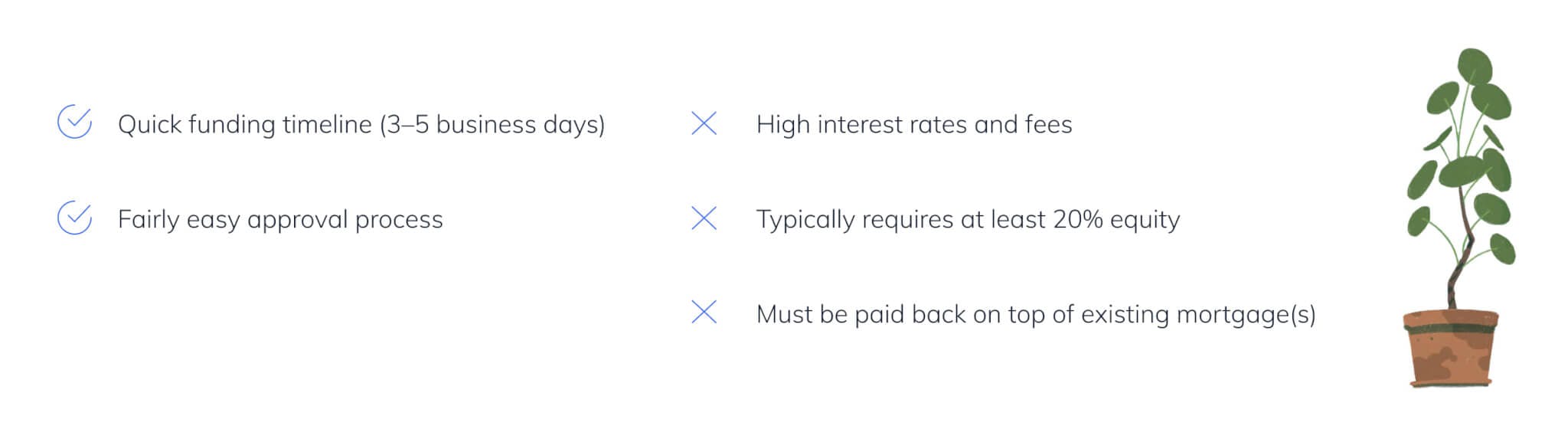

Let’s recap:

Pros:

- Quick funding timeline (3–5 business days)

- Fairly easy approval process

Cons:

- High interest rates and fees

- Typically requires at least 20% equity

- Must be paid back on top of existing mortgage(s)

Alternatives to a Bridge Loan

Government Down Payment Assistance Programs

There are a couple of different avenues when it comes to government assistance. The National Homebuyers’ Fund offers coverage of the down payment and closing costs up to five percent of your mortgage total, and features flexible credit and debt-to-income requirements. In addition, there are several state-sponsored programs that vary in terms of qualification criteria and usually take the form of loans or grants.

Your 401K or Roth IRA

If need be, you can dip into your retirement savings instead of taking a bridge loan. While you’ll be penalized for withdrawing your funds early from your 401K, you can borrow up to $50,000 or half your balance (whichever amount is less). With an IRA, you have the freedom to withdraw your contributions, tax-free, any time. However, if you’ve bought a home previously and are under 59 ½ years old, you’ll deal with penalties if you take money out of your investment earnings, so you’ll need to be careful if you go this route.

Read “Borrowing from 401(k) Retirement Savings: What You Need to Know” to learn more about this option >>

Your Stock Holdings

If you’re in a pinch, you can sell your stocks to get enough cash to cover your down payment. Alternatively, a more complicated approach is to get a loan that uses the stocks as collateral. You’ll only be able to borrow a percentage of the stocks’ market value, and while interest rates may be lower, the funding you’re able to access fluctuates based on how well the stocks are doing. This can get you into trouble and lead to forced liquidation if they dip too low.

Since this is a fairly involved process, if you are considering this option, it is probably worth your while to check with a financial advisor prior to making any decisions.

Home Equity Investments

Home equity investments have emerged as an alternative to traditional bridge loans. Many providers, including Hometap, don’t have any prepayment penalties to worry about. This makes them a great short-term solution if you want to avoid the added costs, hassle, and stress of bridge loans. The time from application to funding can take at least a few weeks, however, so if you need cash urgently — in a matter of days — a bridge loan may still be a better choice.

The more you know about your home equity, the better decisions you can make about what to do with it. Do you know how much equity you have in your home? The Home Equity Dashboard makes it easy to find out.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.